Coffee Analysts Prediction: Higher Coffee Prices Not Likely to Last

Dan Cox of Coffee Analysts was recently asked by Nicole Krug of The Washington Times to comment on the current price hikes that have been implemented by Smuckers, Folgers, Kraft, and most recently, Starbucks. These coffee brands and other specialty roasters have pushed up prices for bagged coffee and some drinks as the replacement costs of their Arabica bean supply have increased relevant to current inventory values. READ HERE

Dan Cox of Coffee Analysts was recently asked by Nicole Krug of The Washington Times to comment on the current price hikes that have been implemented by Smuckers, Folgers, Kraft, and most recently, Starbucks. These coffee brands and other specialty roasters have pushed up prices for bagged coffee and some drinks as the replacement costs of their Arabica bean supply have increased relevant to current inventory values. READ HERE

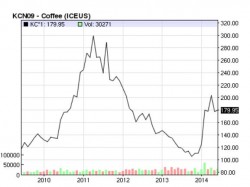

The coffee market was below 120 usc/lb for much of the second half of 2013 (when inventory was secured for 2014 and 2015), but from January to March of 2014 the coffee market increased rapidly to over 200.00 usc/lb and has only recently weakened below 200 usc/lb since early May. So, even though the coffee market is slightly weaker than earlier in the year, the cost to buy fresh coffee for the remainder of 2014 and 2015 is greater than before. J.M. Smucker Co. has increased the cost of its Folgers and Dunkin’ Donuts brands of packaged coffee sold in grocery stores by about 9 percent, while Kraft raised prices on Maxwell House and Yuban coffees by 10 percent. After recently stating they would not be raising prices, Starbucks coffee customers have started paying 5 to 20 cents more for a cup of coffee in-store and will see a $1 price boost on packaged coffees sold in supermarkets and other retail outlets July 21st. The recent price jump is the result of several factors, including lack of rain in Brazil, too much rain in Central America, rising fuel costs and the beginning of the slower drinking season, said Mr. Cox. After looking at the coffee market over the last 5 years, we see a lot of similarities to the 2011 coffee pricing spike, described below:

- 2011: Increased demand in emerging economies. China + India’s emerging markets were used as examples. At that point, by year 2015 Brazil was expected to be keeping more than half of its own formidable annual coffee crop for internal consumption. 2014: This year, Russia is also a major player in the emerging economies demand, and Brazil’s expected interior consumption impact on availability has been pushed off until 2020.

- 2011: Sustained high demand in traditional major coffee markets (e.g., U.S., Europe.) 2014: This factor also applies to our situation this year.

- 2011: Supply disruptions due to inclement weather. 2014: This also holds true, with the added problem of coffee tree rust (roya) that has caused a production decline in Central America and Mexico for the past two years. An aggressive tree renovation program has improved some of the production area this year.

- 2011: Avoidance of increased production investment due to fear of boom-bust cycle and the three to five years required for coffee plants to mature. The Brazilian government in particular had stated this general theory in regard to their country’s coffee market and had refused to incentivize increased production. The country had also withheld coffee stocks from sale in anticipation of high future prices, and this act in and of itself helped to drive prices upward. 2014: As of late 2013, the Brazilian government still had not offered help to growers months after the government recognized a need for it.

- 2011: Speculative trading in coffee futures markets with large infusions of money from hedge funds, driving up commodity prices based in macro-economic supply side concerns across the board. 2014: The change here is that the players that are investing in smaller businesses are not really impacting supply side concerns, although hedge funds and private equity firms are still interested in coffee. Within the last year, San Francisco Bay Area coffee chain Philz Coffee recently raised eight figures (reportedly between $15 million and $25 million) from growth equity firm Summit Partners. Blue Bottle Coffee has garnered $20 million in a round led by True Ventures with participation from Index Ventures and Google Ventures. In late January, Blue Bottle won another $25.75 million in a round led by Morgan Stanley Investment Management. And technology celebrity Jack Dorsey of Twitter and Square fame made an angel investment in up-and-coming Sightglass Coffee, a local California Bay Area business.

Historically, coffee has been at the mercy of external forces affecting the global commodity prices, and this occurrence will continue into the future. Because of the ever-changing nature of agricultural crops, we see coffee commodity prices remaining volatile do to unforeseen weather, financial and political issues, as well as variations in crop quantity and quality. Global demand continues to increase for both total quantity and per capita consumption, including the increased demand for specialty quality coffee served in café’s and coffeehouses around the world. Coffee growers face many challenges in delivering coffee into the farm-to-cup supply chain and continue to persevere to provide coffee for consumption while providing income for their families. So just hang onto your coffee cups and hope for the market to smooth out!